As we talked about in our last article, “Digital Ownership – An Epic Slice of Apple’s Pie”, there are issues surrounding ownership of digital assets, that we take for granted as part of our digital ecosystem. The digital world is unwieldy and the best products conceal this complexity to customers.

This isn’t a critique on the design principles of Apple, a group that favors simplicity and intuitive design over intense modularity. Their success can be attributed to attending to customer needs, without extra baggage. However, if Apple fails to meet needs or expectations, the customers are left without recourse.

A similar situation can be outlined for Epic Games’ hit, Fortnite, a 3rd person shooter with cartoonish graphics. The business model of Fortnite is based on the purchase of cosmetic accessories, with no competitive advantage. By keeping costumes contained within this single game, it encourages continued participation in the platform. To consider that skins would be used outside of the Fortnite world is an unnecessary technical challenge to undertake. There would be additional cost and complexity, with no significant return on investment.

Given this example, we can see the disincentives for allowing digital assets to be usable on platforms without a means of capitalization. This is done through platform ownership, and 3rd party platforms can play by their own rules.

The modus operandi of every successful business requires placing their success and longevity first. While most businesses start as an innovative venture, very easily it can turn into a rent-seeking entity. Then a newcomer, frustrated with the rigidity of current industries, can flip everything on its head. These are our startups, who capitalize on opportunities unseen to the overly indoctrinated.

What if we didn’t need to do this? Can the old be receptive to the new?

As unintuitive as it might sound, prioritizing the needs of other groups and voices can help support success and longevity for the company.

As we established, Apple products and Fortnite are platforms, and their customers are users granted access to their platform. While the users can be potentially infinite, the owners are limited.

I say the owners are limited… yes, there could be public stocks associated with the corporation. However, this does not translate into autonomy or decision making power for the stock owner. Ownership of a stock does not translate into a seat in the board room. Or… What if it did?

If we want to give every stock holder a voice, why couldn’t we? It seems unreasonable, but the empowerment of every owner might be worth it for the longevity and vitality of the organization.

There are numerous issues that come up, but the primary one is: How do we come to consensus, for a single decision?

Normally, this is done with a Board of Directors. Once on the board, each director has a vote. We avoid the complexity of balancing thousands of participants, by reducing participation down to a manageable size, with the average board being 9.2 members.

With the hope that the directors are representing the interested parties fully, this seems like a fair and equitable system. However, in its worst form, this centralization of decision making can lead to a lack of accountability or transparency.

There is also the matter of reaching the board of directors. Access is difficult, but this can be seen as a helpful validation mechanism. Because it is hard to reach only the members that care the most, will be granted access.

Let’s explore the other possibility: An open majority vote, for all partial owners.

If we open the vote to all, we allow all interested parties to vote, and have their voice be heard. By allowing more voters and a more distributed decision, this is nothing but good right?

While it might sound nice to allow all owners to vote into matters, this can have several destructive effects. Herd mentality will prevail, and the forethought required to make sustainable decisions, will not be given the due diligence to be heard.

Good faith voters would not be familiarized with the company on a deep enough level, to make the best executive decisions. Bad faith voters, could actively sabotage the company with bad decision votes, to help the competition.

We’ve entertained the current models of shared ownership, by continuing to value each person as one vote. Yet, by looking at the Board voting system against the Democratic voting system, we can make the observation that not all votes are created equal.

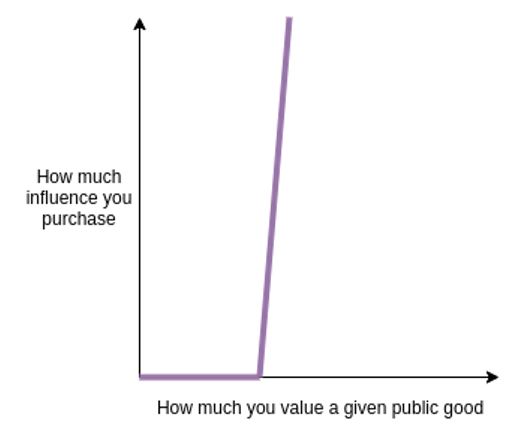

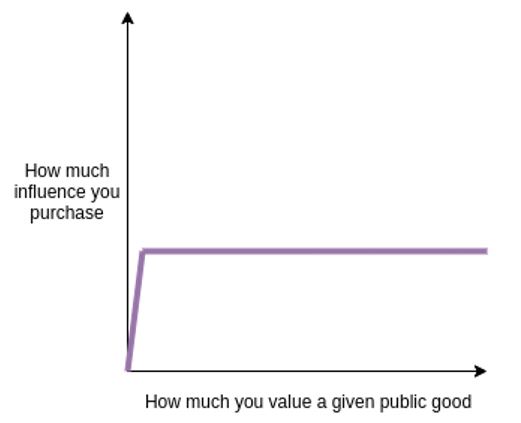

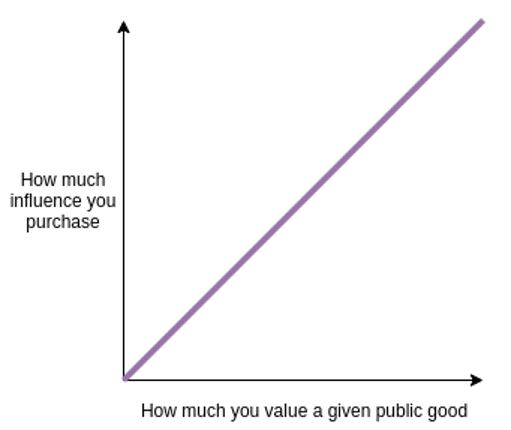

This is where we can start to look at a model of voting called “Quadratic Voting.” Instead of each person getting access to 1 vote, each person can get access to N votes, with a cost of N per vote.

As the number of votes goes up, the cost of that subsequent vote goes up.

This specific solution allows for each voter to have a baseline decision-making weight, but also allows for voters to have their commitment recognized.

Let’s take a step back… This analysis started by looking at the technology involved with digital ownership, as it relates to customers and the platforms they use. Yet to understand the fundamentals we are forced to do an analysis about an older technology: the invention of ownership and property rights.

The examples of company boards and publically traded stocks are related to private corporations. It is important to recognize that these are private market solutions to the sharing of ownership. Private goods are dictated by the dynamics of property ownership, risk, and the free market value, which don’t necessarily have the same incentives as public markets.

As it is presented by Vitalik Buterin in “Quadratic Payments: A Primer“ quadratic voting is suited best for public goods and markets.

This is also why this comparison is more essential than ever: there have been many designs to offer more equitable solutions for all participants, as it exists in the private markets.

These are all healthy and desirable goals. For the public sector, these are the core virtues and values.

The solution is somewhere in the middle. Where we can allow for the virtues of the free market and for shared outcomes and decisions, to flourish.

References:

English | EN

English | EN