The UPI Unified Payments Interface (UPI) is a real-time payment system developed by the National Payments Corporation of India (NPCI) in 2016 that enables instant transfer of money between bank accounts using a mobile phone or computer. It is a highly secure and user-friendly platform that facilitates peer-to-peer (P2P) payments, merchants payments, bill payments, and other transactions. UPI is an interoperable platform, which means that users can make transactions between different bank accounts and different banks using a single mobile application.. Let’s now turn our attention to the Data equation, which happens to be my day job and a critical aspect that keeps the business running smoothly.

The UPI creates a whole ecosystem around it, much like a Banyan tree. See the linkages now:

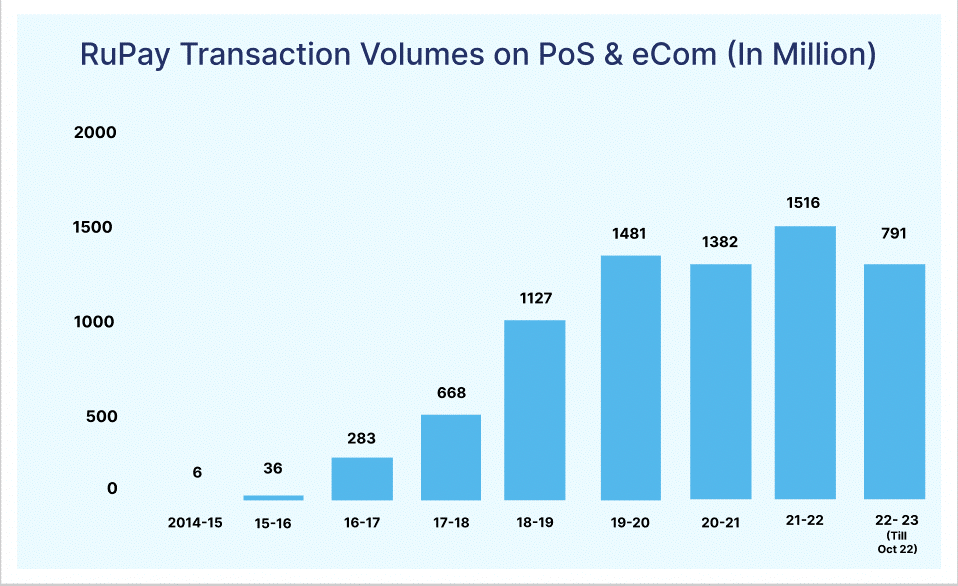

RuPay – The Government of India has launched RuPay, a fully indigenous Card system that aims to reduce the country’s dependency on foreign providers and stimulates the growth of the Indian commercial ecosystem, while also keeping costs low.– The linkage between RuPay and UPI lies in their interoperability. RuPay cards can be easily linked to UPI IDs, enabling users to conveniently make payments through their RuPay cards on the UPI platform. Similarly, UPI can be used to make payments on the RuPay network, allowing users to withdraw cash from ATMs and make purchases at merchants that accept RuPay cards, thereby enhancing the overall convenience and accessibility

RuPay has seen a… hold your breath; 250X growth from 2012 to 2023. Currently, the number of RuPay cards in circulation has surpassed one billion, generating massive volumes of spatial, financial and demographic data.

P2P Payment ecosystem – India’s PRP payment landscape had created numerous unicorns, with one unicorn emerging each week, and many of them now profitable What is the linkage between UPI and P2P? UPI acts as the central nervous system for the P2P providers. This is testified by the extensive network of over 20 players – some of which are listed below.

Google Pay, Paytm, PhonePe, BHIM (developed by the National Payments Corporation of India), Amazon Pay, Mobikwik, Freecharge, WhatsApp Pay, Truecaller Pay, Airtel Payments Bank, JioMoney, PayPal, CRED, Simpl, Ola Money, Yono SBI, ICICI Pockets, HDFC PayZapp, Axis Pay, KhaaliJeb

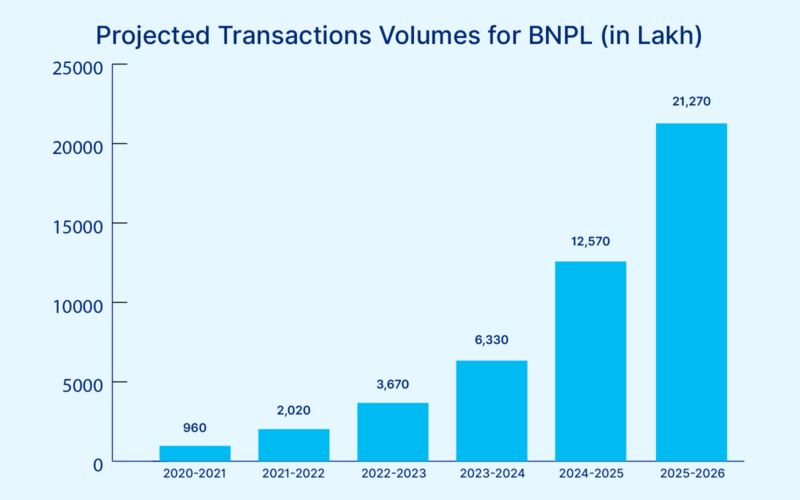

The digital penetration we have seen is massive. The P2P network alone has facilitated over Rs. 12.9 Lakh Crores (equivalent to € 156 Trillion) of transactions.

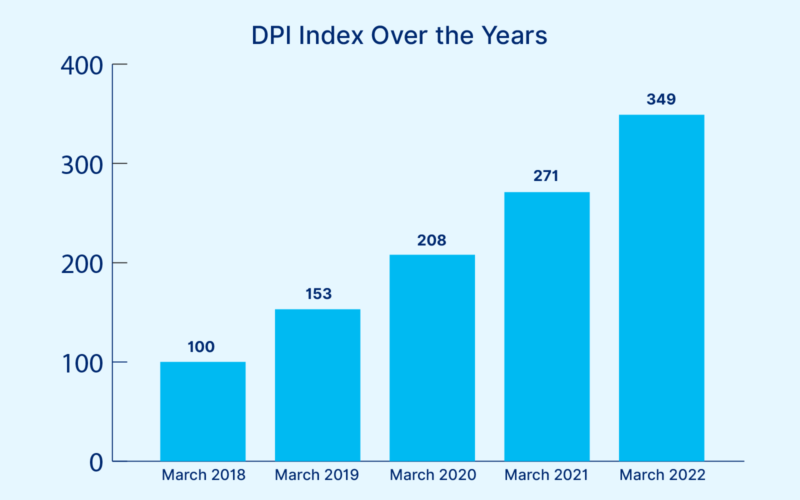

Digital Payment Index – In March 2018, the DPI was launched and baselined to 100. This index is calculated biannually, capturing data for March and September. The RBI-DPI consists of the following five parameters that measure the depth and penetration of digital payments across the country over various periods.

- Payment enablers

- Payment infrastructure – demand-side factors

- Payment infrastructure – supply-side factors

- Payment performance

- Consumer centricity

As of five months ago, the DPI had reached 377, showing steady growth since March 2022 when it was at 342. This marks a significant increase since its launch five years ago, having quadrupled since then.

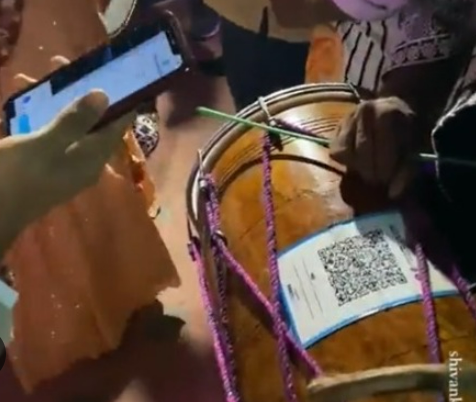

Cardless Withdrawals – Next level banking convenience using UPI which allows customers to withdraw cash without having a physical card. Here is how the process typically works:

- The user needs to open their UPI-enabled mobile banking app and selects the option for cardless cash withdrawal.

- Once on the cashless withdrawal screen, the user needs to specify the amount they wish to withdraw and select the bank account from which they want to make the withdrawal.

- The app generates a one-time Password (OTP) or a QR code, which the user needs to use to withdraw cash from an ATM.

- The user then goes to an ATM that supports cardless cash withdrawals and selects the option for cardless cash withdrawal.

- The user enters the OTP or scans the QR code displayed on their mobile app at the ATM and enters the withdrawal amount.

- Upon successful authentication, the ATM dispenses the cash and the transaction is complete.

International Network –

The international expansion UPI has begun with its successful launch in Singapore. This is undoubtedly a significant milestone, and we anticipate that other countries such as the UAE, Indonesia, and Mauritius will soon join this journey.

What does this mean for the country – The integration of Aadhaar, 4G, upcoming 5G, and UPI has resulted in a data explosion of mammoth proportions, with significant implications for India. In a separate article, I will delve into the power of this integration, but for now, here are three reasonable conclusions drawn from India’s experience:

- Lower foreign exchange costs, fees and faster transfers between countries with large Indian Diaspora

- Retention of money in INR instead of USD thereby strengthening the local currency and fortifying it against shocks

- As the volumes of Rupee trading grow, it’s inevitable that India will become the sixth currency in the IMF’s SDR – The impact of this is that countries will have to maintain reserves in SDR (indirectly INR as well)

Here are some of the different types of data generated by the UPI ecosystem:

- Transaction data: This includes information on the number and value of transactions processed through the UPI platform, as well as details of the sender and receiver of the transactions, the time and date of the transaction, and any associated fees or charges.

- User data: This includes information on the users of the UPI platform, such as their personal details, bank account information, and transaction history. This data is typically stored securely by the banks or payment service providers that offer UPI services.

- Device data: This includes information on the devices used to access the UPI platform, such as the type of device, the operating system, and the version of the app or software used to initiate transactions.

- Location data: This includes information on the location of the user and the device at the time of the transaction, which can be used to help detect fraudulent transactions or identify patterns of usage.

- Performance data: This includes information on the performance of the UPI platform, such as the speed of transaction processing, the reliability of the system, and any issues or errors that may arise during transactions.

- Merchant data: This includes information on the merchants that accept UPI payments, such as their business details, transaction history, and sales data.

These are just a few examples of the types of invaluable data generated by the UPI ecosystem. The collection and analysis of this data can provide actionable insights into the behavior and preferences of users, as well as the trends and patterns in digital payments in India. It is important to note that this data is subject to strict privacy and security regulations to protect the personal information of users. Data providers are in for an exciting decade ahead mining, monitoring and drawing conclusions from this rich reservoir of data which will further fuel the engine of growth.

English | EN

English | EN