SALESFORCE SPOTLIGHT: INSURANCE COMPANIES

November 23, 2015

One of the things that I find the most fun in my work is when I get to be creative and get to inspire. This often happens when solving problems or thinking out-of-the-box. The latter is exactly what this post is about. The insurance industry is the first in hopefully a long series of blogs, that looks at how exactly Salesforce can make a difference.

more–>

The Industry’s Market

Insurance is as we know them (at least in Denmark). You enter into an agreement for a year at a time and pay either yearly or monthly. We have them in the hopes over never needing them, and if we need them, we expect to be able to reach our insurance company fast. When we get through to them, we expect them to be ready to help us with our problem (often a damage claim or a product question) and we expect the process to be smooth and simple.

For the insurance companies I can imagine that there will be measured on anything from ACV (Annual Contract Value), MRR (Monthly Recurring Revenue), 1st time resolutions, number of claims, number of calls, amount of damages paid, coordinating emergency operations (e.g. when natural disasters hit) etc.

Which challenges does the industry face?

In collaboration with European Financial Management Association (EFMA), Capgemini has published the ”World Insurance Report 2015” – the 8th report in the series (see the most important points in 4 minutes). In the report more insights are provided as to the bigger challenges the industry faces. What leaps into my eyes, is that the survey revealed “… an alarming drop in customer experience scores”, and that it was namely the digital challenges that was responsible for the poor experience.

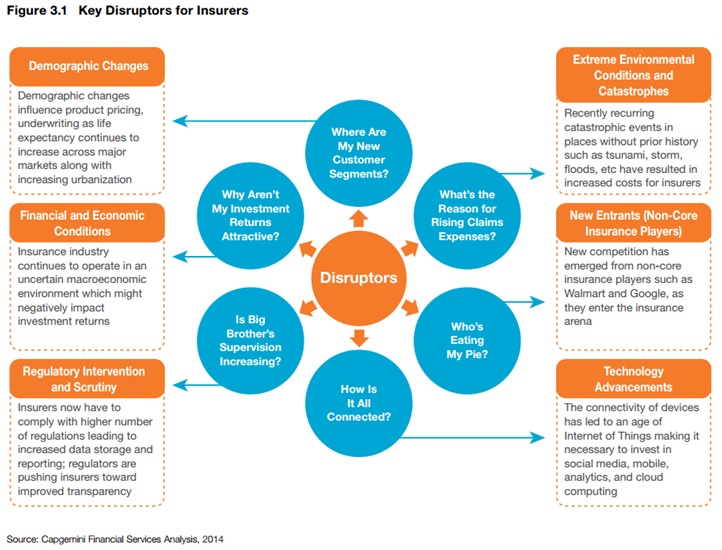

In addition, the industry is facing several other challenges, namely:

- Generation Y placing an unforeseen amount of value on the mobile and social experience, which places pressure on the combined experience of the interactions with the company

- Big Data is mentioned by a whopping 78% of directors as being the biggest challenge for the industry

- And of course the classic requirements to reduce costs and increase profitability

How does Salesforce fit?

Salesforce, by now, is known by all. Undoubtedly, it is the biggest success on the CRM market in the recent days. What everybody doesn’t know, is that the portfolio of offerings is getting so vast that it can address many of the business needs – not just sales. What’s common for all their products is that it is built on a platform that is among the leaders within security and a platform that thinks mobile first.

Considering the market, business model and industry challenges, I believe that Salesforce fit Insurance Companies in the following ways:

- Damage claims can be revolutionized. Imagine the following: As a private person (or someone who’s out inspecting the damages), it will now be possible to report the claim via mobile (potentially take a photo). When you file the claim, you fill out a series of fields (some pre-filled given that you are already logged in), and the minute you press “Send” the claim will be routed to the right department, with the right information, priority, category etc. and the team responsible will be notified that there is a new case. If you are in trouble or need assistance, you’d simply be able to push the “Contact us” or “Chat” button and then you either call or will be connected directly with an agent. Everything happens via mobile (or from the web). You could even incorporate a live video feed from within the mobile app using Service Cloud SOS.

- Claim handling time goes down remarkedly. Using so-called approval flows, it enables the employee to handle the claim, and then send the decision to get approved. It could be that all payouts over X dollars always require a manager’s approval or an extra review. In case you need to talk to another colleague about the claim, you connect with them via Chatter to keep the conversation directly on the claim, to ensure not only the history but also to make sure that you have all the necessary data at hand.

- Customer Service gets one platform. Using Service Cloud, customers can now contact you through all channels (email, social, chat, phone, web, etc.) and the work itself will be streamlined. You can create a bunch of automations that helps the team reach their goals faster, and because claims can now be handled from all channels – including from within mobile apps – customer service moves closer to the customers and is fully accessible, in line with Generation Y’s expectations.

- Self-service is optimized. Salesforce Communities is a customer portal that can be adapted to your needs. You can show the customers their insurance as well as other relevant information. In addition, it can be easily integrated with Live Agent (chat) and Knowledge. The latter is a knowledge database directly integrated with Service Cloud. This enables the customers to search for answers themselves. All in all, the features above can help to reduce the amount of contacts – and through that, the costs.

- Reporting is done in real-time. Whether you use the standard Dashboards or Salesforce Wave (BI), you get the opportunity to present data in Real-time. Dashboards make it possible for you to easily keep tab on the collected annual contract value for your entire customer portfolio (even distributed on segment, age, region etc.), you can see total amount of claims (distributed on hours, days, weeks, months etc.) and you can follow the searches in the knowledgebase to identify whether an article is needed, to reduce the amount of calls. The wonderful thing is that all reports and dashboards can be accessed on all mobile devices.

- Forecasting becomes even more accurate. Using Sales Cloud (CRM), which today is leading within its segment, you gain a complete overview of your pipeline. You can build automations that alarm sales people not just about an insurance experience, but also as to when they last had an insurance check. You can easily see how the revenue is distributed on new versus existing customers, across segments, age, geography etc.

- 360 degree view can be achieved in the B2C segment via Person Accounts and regular accounts for the B2B segment. Essentially, it becomes possible to see the customer’s entire engagement in one place, ensuring that you always have all information collected in one place, and through that, can deliver the best service.

- Marketing Cloud is the new black. Unfortunately you cannot talk about this product without tossing a lot of buzzwords around like Marketing Automation, Customer Journeys, Proactive Customer Service, Social Engagement etc. Essentially, marketing cloud covers three areas: Email Marketing, Social Media Monitoring, and Analytics. Using data, it becomes possible for you to take control of the total customer experience, personalize it and deliver the WOW-factor.

Summary

Salesforce is one of the few companies that insist on being at the front. They have been successful in all the segments they have addressed. They are one of the few companies that have a leading product within not only Sales but also service and marketing. Most importantly of all – what Salesforce does, can inspire others to see opportunities – whether it be on the Salesforce platform or not.

In other words, Salesforce is a solution that can help you get ahead. One of the elements that, among other things, is showcased in the World Insurance Report 2015, is the so-called “Insurance ACE” – or in other words – ”Insurance All-Channel Experience”. This is the demand posed by the new generation of customers, and I believe that Salesforce is a platform that is uniquely positioned to address this need. An extraordinary customer experience.

Image credit: appirio.com

English | EN

English | EN