The distribution of commercial P&C insurance lines has always been difficult to characterize, given its complexity and variability. At the 35,000-foot level, the split has been relatively clear-cut.

- Micro- and small-commercial is increasingly moving to digital, turnkey channels that can quote and bind conventional lines with minimal friction

- Mid- and large-commercial distribution remains dominated by humans with behind-the-scenes bots and automation acting as assistants

The era of Covid has helped accelerate this dichotomy, with clear lines being drawn between the two areas.

In this discussion, we’ll cover some of the implications of these trends.

Micro- and Small-Commercial: Direct Digital Distribution

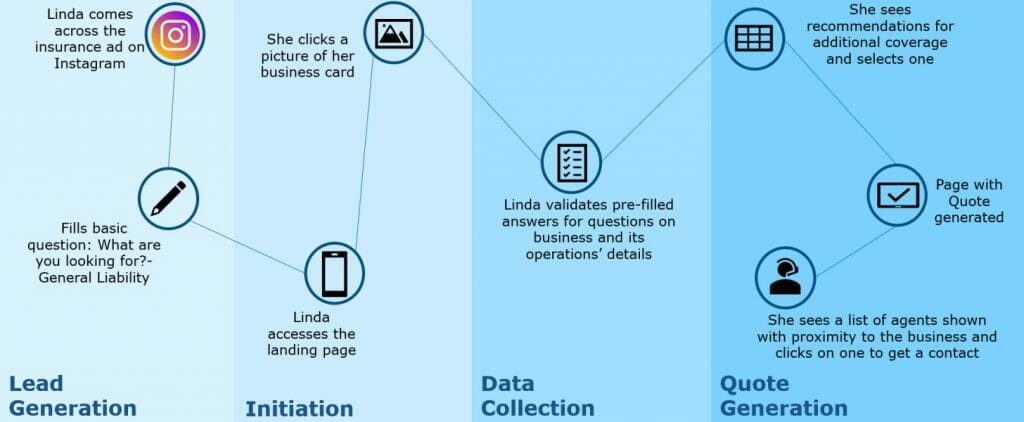

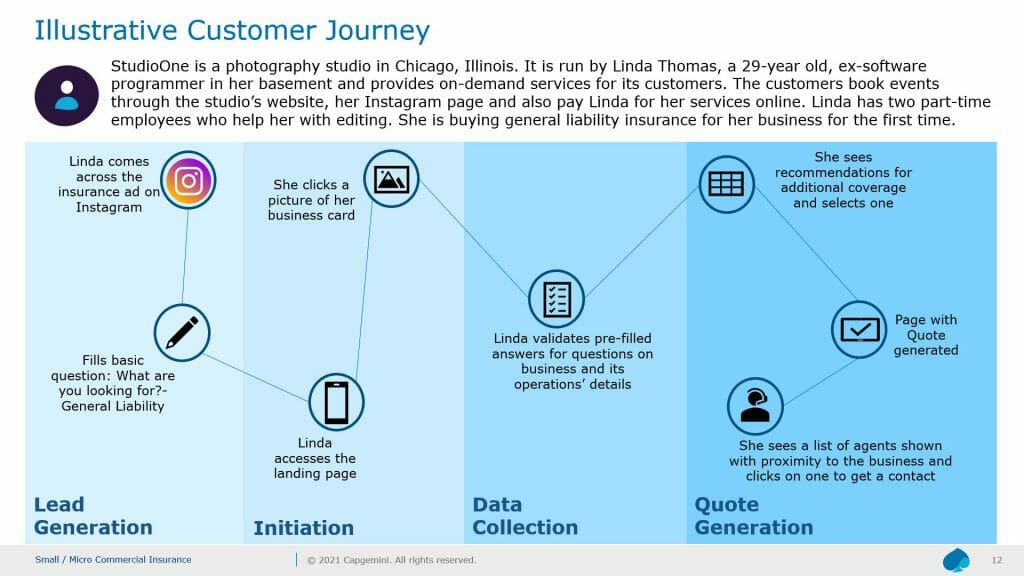

Direct digital distribution can be best illustrated by a customer journey.

In this scenario, social media (e.g., Instagram) is used as a lead-generation vehicle for General Liability insurance products. The prospect is directed to a landing page where basic information is collected, recommendations made, a preliminary quote generated and agent contact information exchanged.

In short, many of the front-office business processes are digitized and automated. Human effort is reserved for complex product configurations, advisory services, and other value-added activities.

Mid- and Large-Commercial Distribution: The Human Relationship At the Center

Conversely, in mid- and major commercial markets, human relationships — from the agent, to the underwriter, support personnel, branch executives, etc. — remain at the center of the distribution flywheel.

In one of the more interesting cases we’ve seen, a broker focused on reducing the time between quote and the accept/decline decision has introduced a unique process.

To speed up the process the broker rates individual human underwriters, not the carriers writing the business. Think of it like an NFL draft for underwriting talent, where human experts can sense the right business process and the right individuals to help. In these cases, the carrier is a secondary consideration to the human relationship.

On the carrier side, some organizations are building tools to help understand their producer relationships. These entail understanding agents on a personal level, linking them to accounts, underwriters, administrative support personnel, branch/field executives, etc. to streamline the workflow for complex deals.

That’s not to say that technology isn’t critical in the mid/large commercial space. It is, but the tech stacks are centered around human relationships. Our research with brokers show that they value:

- Faster decisioning

- Easier ways to submit business

- Transparency into the carrier processes that result in a decline or an acceptance

Behind the scenes at the carrier, these capabilities are enabled by API products, data standards, intuitive user interfaces, real-time notifications, and the like.

A major focus in the middle market is the emphasis on doing the basics right the first time. Issuance, billing and collections, and mid-term endorsements are all fertile ground for improvement with technology.

Speed and transparency are always areas of interest for distribution. Rapid decisioning obviously hinges on advanced technologies, with appetite, quick declines, rating, pricing, and deal optimization driven by increasingly sophisticated models augmented with AI/ML.

We’re also seeing an interesting development in the AI/ML space. The models themselves seem to be less differentiating; the real value appears to be based upon the computing infrastructure to fabricate models more quickly, deploy them automatically, test them, and accept or reject their results while curating aspects of the model to advance to subsequent generations.

These “meta-models” will be increasingly AI-driven, to the point where model generation could be largely automated in more sophisticated carrier ecosystems.

Implications

We see several significant implications for brokers and carriers:

- War for talent: the combination of human and digital talent will be uniquely valuable in driving successful distribution results in an increasingly competitive environment. Proven producers, underwriters and other key personnel will be central to success;

- Humanistic: understanding the “who” — the fine-grained human relationships at the heart of deal flow — will be critical to drive complex agreements to closure. Speed of collaboration, deal structure, negotiation, etc. will hinge on a holistic view of the individuals contributing to the entire process;

- Technology as the accelerant: while humans are at the center of the distribution flywheel, technology can serve as a critical differentiator. Whether in the form of APIs, push notifications, portal interoperability, advanced visualizations of deal financials, and scalable/self-learning models, tech will be a key catalyst for improvement.

Organizations that adapt fastest to these evolving distribution models will likely be best-positioned for rapid growth and margin improvements.

###

Capgemini has developed a unique portfolio of offerings related to commercial insurance, based upon broad and wide-ranging discussions with carriers, agents, brokers and key insureds.

For more information about our P&C research, trends and predictions, please contact me.

###

English | EN

English | EN