Accompanying the rise of AI services in the high-growth enterprise segment are important questions from leadership. Often questions revolve around the stewardship of AI:

- “How do we innovate quickly but safely?”

- “What are the regulators doing?”

- “What are the auditors saying?”

The 2024 market for AI services is estimated to have been $214 billion, with the 2030 spending estimate topping $1.3 trillion.

These numbers highlight the fact that these questions are both timely and crucial for leaders.

The reality

In a startup, injecting AI into new offerings and processes is relatively easy. That’s not the case in most larger organizations. They have technical debt and cruft left over from acquisitions, divestitures and joint ventures.

Further, budgets are always constrained. Many IT organizations have two to four times as much demand as they have capacity.

AI offers a chance to close the demand-to-capacity gap but it also raises concerns over control and auditability. Firms should consider the regulatory and legal landscape for their industry and operating locations.

Assessing risk

Using several models and approaches, we asked AI to assess the risks of… AI. Interestingly, the results were relatively consistent across runs and models.

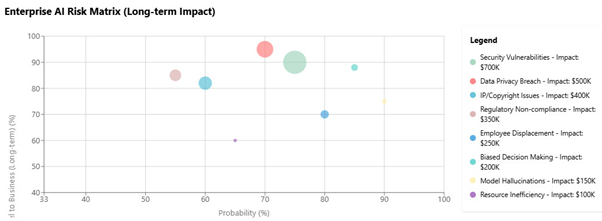

AI Risk Assessment (Claude-3.5-Sonnet) – Run 1

We ran the model dozens of times using a range of hyper-parameters.

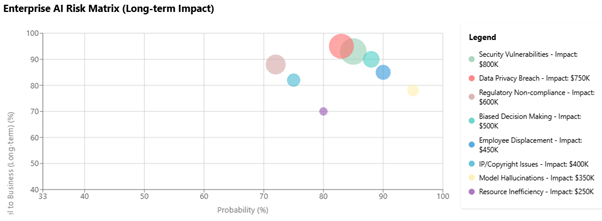

AI Risk Assessment (GPT-4o) – Run 5

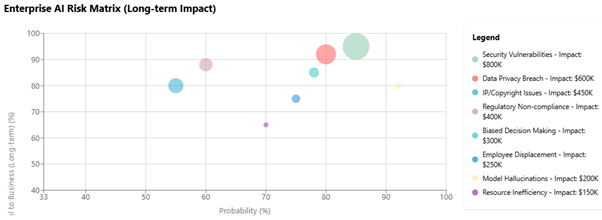

AI Risk Assessment (Claude-3.5-Sonnet) – Run 10

The top four risks were consistent among runs and across models:

- Security vulnerabilities – ensuring a robust security posture at all times.

- Data privacy breaches – safe handling of sensitive data while complying with laws, regulations and ethical standards.

- Regulatory non-compliance – conformance to applicable legal and regulatory requirements.

- IP/Copyright issues – copyright ownership may be in question for a few foundation models.

These kinds of analyses can help hone focus for organizations on the right targets for investments.

The AI train isn’t slowing down

When it comes to adoption, reports describe how the following segments [AS2] are moving quickly.

Finance: Over 34% of financial institutions reported revenue increases of over 20% due to AI adoption, with 51% seeing at least a 10% increase. The financial sector has seen significant growth through AI applications in customer service, fraud detection, and personalized financial advice.

Healthcare & Life Sciences: This sector is set to witness the fastest growth rate in AI application, driven by advancements in diagnostics, drug discovery, and personalized medicine.

Manufacturing: The manufacturing sector expects gains of $3.8 trillion by 2035 from AI adoption, focusing on automation, predictive maintenance, and supply chain optimization.

Retail: AI market size in retail is projected to reach $257.43 billion by 2032, with applications in inventory management, personalized marketing, and customer service enhancing operational efficiency.

The key is balance

The business outcomes AI can influence are real and growing. Simultaneously organizations must be able to answer questions about risks from regulators, auditors and—most importantly—stakeholders. A balanced and risk-adjusted approach is recommended.

English | EN

English | EN