This week I am continuing a series on the value and impact of Data Governance in a variety of business sectors. I am hopeful that this will give you some idea of how Data Governance can be helpful even in industries where it’s either considered low value or hard to implement. From my personal experience, several of these industries have expressed to me that it makes no sense to implement Data Governance because there is little value for them. This week I’m working through Finance and E-Commerce and how Data Governance can be of critical value to those who understand how to implement it and its true value.

In both Finance and E-Commerce, data is the foundation of decision-making, customer engagement, risk management, and innovation. However, the volume, velocity, and variety of data in these sectors can present serious challenges if not managed effectively. This is where data governance structured frameworks for managing data quality, security, compliance, and accessibility become a strategic necessity rather than an operational luxury.

The Critical Value of Data Governance in Finance and E-commerce

Data isn’t just a byproduct of business; it is the business. It’s the currency of personalization, the compass for strategic risk, and the bedrock of customer trust. But this asset becomes a massive liability without control. Data governance the formal framework of policies, standards, and processes that ensure data is managed securely, accurately, and ethically is the critical discipline that separates data-driven leaders from data-swamped laggards.

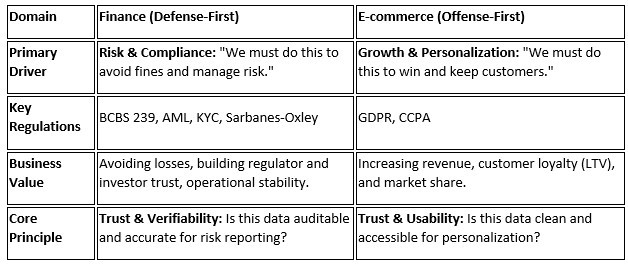

While the principles of data governance are universal, its application and primary value drivers look dramatically different in two of the world’s most data-intensive sectors: Finance and E-commerce.

For finance, governance is fundamentally about defense and trust. It’s a shield against catastrophic risk and regulatory penalties. For e-commerce, governance is primarily about offense and growth. It’s the engine for hyper-personalization and customer loyalty.

Data Governance in Finance: The Bedrock of Trust and Stability

In the financial services industry, poor data isn’t just an inconvenience; it can be existential. A misplaced decimal, a faulty risk model, or a compliance breach can trigger billions in losses, regulatory fines, and irreparable damage to public trust. Here, data governance is non-negotiable.

Key Impact Areas:

Ironclad Regulatory Compliance (Defense)

This is the single biggest driver for data governance in finance. Banks and financial institutions operate under a complex web of stringent regulations. Data governance provides the framework to prove compliance and avoid crippling penalties.

- Anti-Money Laundering (AML) & Know Your Customer (KYC): Governance ensures that customer data is accurate, complete, and consistent across all systems. This allows banks to verify identities, monitor transactions for suspicious activity, and report to regulators with confidence.

- BCBS 239: The Basel Committee on Banking Supervision’s “Principles for effective risk data aggregation and risk reporting” (BCBS 239) is essentially a mandate for robust data governance. It requires major banks to have the ability to quickly and accurately aggregate all risk data, which is impossible without clear data ownership, lineage, and quality controls.

Proactive Risk Management (Defense)

The 2008 financial crisis was, in many ways, a catastrophic data failure. Firms couldn’t accurately assess their exposure to risk. Modern data governance directly addresses this.

- Single Source of Truth: Governance programs break down data silos (where different departments have different, conflicting data) to create a “single source of truth.”

- Risk Modeling: Whether for credit risk, market risk, or liquidity risk, these complex models are only as good as the data they’re fed. Governance ensures the data is high-quality, timely, and has a clear audit trail (data lineage), so banks can trust their models in times of stress.

Operational Efficiency and Trust (Offense)

While driven by defense, good governance unlocks offensive value. When bankers and analysts trust their data, they can make better decisions, faster. It reduces the enormous amount of time spent finding, cleaning, and verifying data, allowing teams to focus on generating insights rather than wrangling spreadsheets.

Data Governance in E-commerce: The Engine for Personalization and Growth

In e-commerce, the margin between a loyal customer and a lost sale is razor thin. The entire business model is built on understanding customer behavior to create a seamless, personalized experience. Here, data governance is the engine that powers this experience while safely handling its highly sensitive fuel: customer data.

Key Impact Areas:

Building and Maintaining Customer Trust (Defense)

E-commerce companies live and die by their reputation. A data breach or the misuse of personal information is a fast track to losing customers forever.

- Privacy Compliance (GDPR/CCPA): Data governance is the operational arm of privacy compliance. It’s the “how” behind the “what” of regulations like the EU’s GDPR and the California Consumer Privacy Act (CCPA).

- Consent Management: Governance defines processes for capturing and managing user consent. It ensures that if a customer opts out of marketing, that preference is honored across all systems.

- Data Rights: It provides the data maps and lineage necessary to fulfill user rights, such as the “right to be forgotten” (deletion) or the “right to access” (providing a user with all data you have on them).

Powering Hyper-Personalization (Offense)

This is the primary growth driver. The “Customers who bought this also bought…” feature on Amazon is a classic example of data-driven personalization. This is impossible without high-quality, well-governed data.

- Unified Customer View: Like in finance, governance creates a single, 360-degree view of the customer. It links browsing history, past purchases, cart abandonments, and support tickets into one reliable profile.

- Trusted Analytics & AI: This unified profile is then used to fuel recommendation engines and marketing campaigns. Without governance, the personalization engine breaks: a customer might get an ad for a product they just bought, creating a negative experience.

Optimizing the Supply Chain (Offense)

E-commerce isn’t just a website; it’s a massive logistics operation. Data governance is critical to making it all work.

- Inventory & Demand: Accurate, real-time data on sales, inventory levels, and supplier lead times is essential. Good data governance ensures this data is consistent across systems, preventing stockouts (lost sales) and overstocking (tied-up capital).

- Accurate Forecasting: By trusting their historical sales data, companies can more accurately predict demand, especially for seasonal peaks, ensuring the right products are in the right warehouse at the right time.

A Tale of Two Priorities, One Foundation

While their primary motivations diverge, both Finance and E-commerce build their data strategies on the exact same foundation.

ROI and Strategic Benefits

In Finance:

- Reduced compliance penalties and audit costs.

- Faster processing of loans, transactions, and customer onboarding.

- Higher accuracy in credit scoring and portfolio risk analysis.

In E-Commerce:

- Higher conversion rates through accurate personalization.

- Lower costs due to optimized supply chain and reduced returns.

- Improved customer retention through trust and service consistency.

Challenges to Implementation

- Cultural resistance to change.

- Legacy systems and data silos.

- Balancing accessibility with security.

- Ensuring ongoing data stewardship and governance council participation.

However, with executive sponsorship, cross-department collaboration, and scalable technology, these challenges can be overcome.

Ultimately, data governance is the framework that allows an organization to trust its own information. For a bank, that trust means stability in a volatile market. For an e-commerce platform, that same trust means knowing exactly what a customer wants, often before they do.

English | EN

English | EN