THE COMPANY AS A THROWAWAY CONCEPT

December 3, 2014

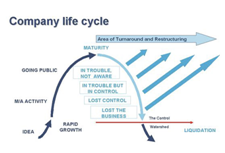

How long should companies live? Could Throwaway Companies become the reality of the future? Companies die, and that’s OK. You’ve probably seen the graph of the average lifespan of the S&P 500 companies: company lifespan is declining and the average may end up being 10 to 15 years at most, and again: there’s nothing wrong with that. I would go even further and say that perhaps ten years should be the max! There are a couple of reasons that lifespan will continue to decline:more–>

How long should companies live? Could Throwaway Companies become the reality of the future? Companies die, and that’s OK. You’ve probably seen the graph of the average lifespan of the S&P 500 companies: company lifespan is declining and the average may end up being 10 to 15 years at most, and again: there’s nothing wrong with that. I would go even further and say that perhaps ten years should be the max! There are a couple of reasons that lifespan will continue to decline:more–>

- First is obviously the relentless disruption taking place in the market, in large part by the exponential nature of Information Technology: the products and services that a company is created to provide are quickly made irrelevant by changing markets and consumer behavior. And IT continues to accelerate (thinking computers, anyone?)

- Second is that the cost of starting a ‘new’ company is still declining. ‘Being a working business’ is turning from an asset into a liability. At some point it’ll become cheaper and faster to start something new than to change something existing. We may already have passed this point, seeing that companies are starting to innovate outside their existing organization. In old times, it took time and effort to organize HR, administrative support, finance, communication and collaboration etc. These days, many of these functions are simply available plug-and-play.

- Third is the acceleration or obstruction caused by corporate culture. At a ‘startup’ or young company, there is appetite, hunger. There are ideas and dreams about what can be. There is creativity. It’s incredibly hard to keep this culture over the lifespan of a company: people get set in their roles, start protecting their positions etc. As Peter Drucker once said: Culture eats strategy for breakfast. Could you realize true innovation building on your old culture?

So how do you design a throwaway company? It would be companies that you construct quickly, grow rapidly and then die (dissolve, perhaps sell?) before the inevitable decline sets in. I’d say you invest heavily on the ‘value’ side and not so much on the ‘avoiding risk’ side. You try to keep an eye on sellable assets for at the end of your lifespan, your ‘exit strategy’. You tell people that they only have a couple of years to make success happen. At the end, you rid yourself of the built-up bureaucracy and sell the process or assets that are still worth something. And if, by chance, at the intended end of your lifespan you happen to be living the peak of your success… who knows?

So how do you design a throwaway company? It would be companies that you construct quickly, grow rapidly and then die (dissolve, perhaps sell?) before the inevitable decline sets in. I’d say you invest heavily on the ‘value’ side and not so much on the ‘avoiding risk’ side. You try to keep an eye on sellable assets for at the end of your lifespan, your ‘exit strategy’. You tell people that they only have a couple of years to make success happen. At the end, you rid yourself of the built-up bureaucracy and sell the process or assets that are still worth something. And if, by chance, at the intended end of your lifespan you happen to be living the peak of your success… who knows?

English | EN

English | EN